Investment principles

Our funds invest in all economic sectors, but they possess specific criteria depending on equity investment size, company size (number of employees, turnover) and geographical areas.

Vauban Partenaires and Participex Gestion have a large investment scope :

Equity investment from € 300K to € 10M

These amounts do not limit the size of transaction as co-investors can invest alongside Vauban Partenaires and Participex Gestion. We took part in a transaction requiring more than € 20M in equity investment.

Company size

Our investment target is composed of small-to-mid caps with turnover ranging from € 15M to € 200M.

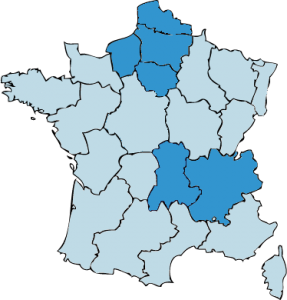

Local companies

Most of our investments take place locally in the provinces of France.

Holding period

Our holding period varies from one investment to an other. It can range from 3 to 8 years. Exits can take the form of a strategic global sale or of a secondary buy-out, and are always made with the agreement of the management.

Economic sector

We do not target specific economic sectors. We focus particularly on promising companies in manufacturing, consumer goods, company services, and distribution companies.

Structuring

Our approach is essentially focused on the value creation approach and is highly technical. It intends to simplify shareholding structures and to get rid of strategic deadlocks. Expansion financing is not our only model and our intervention modes are manifold.